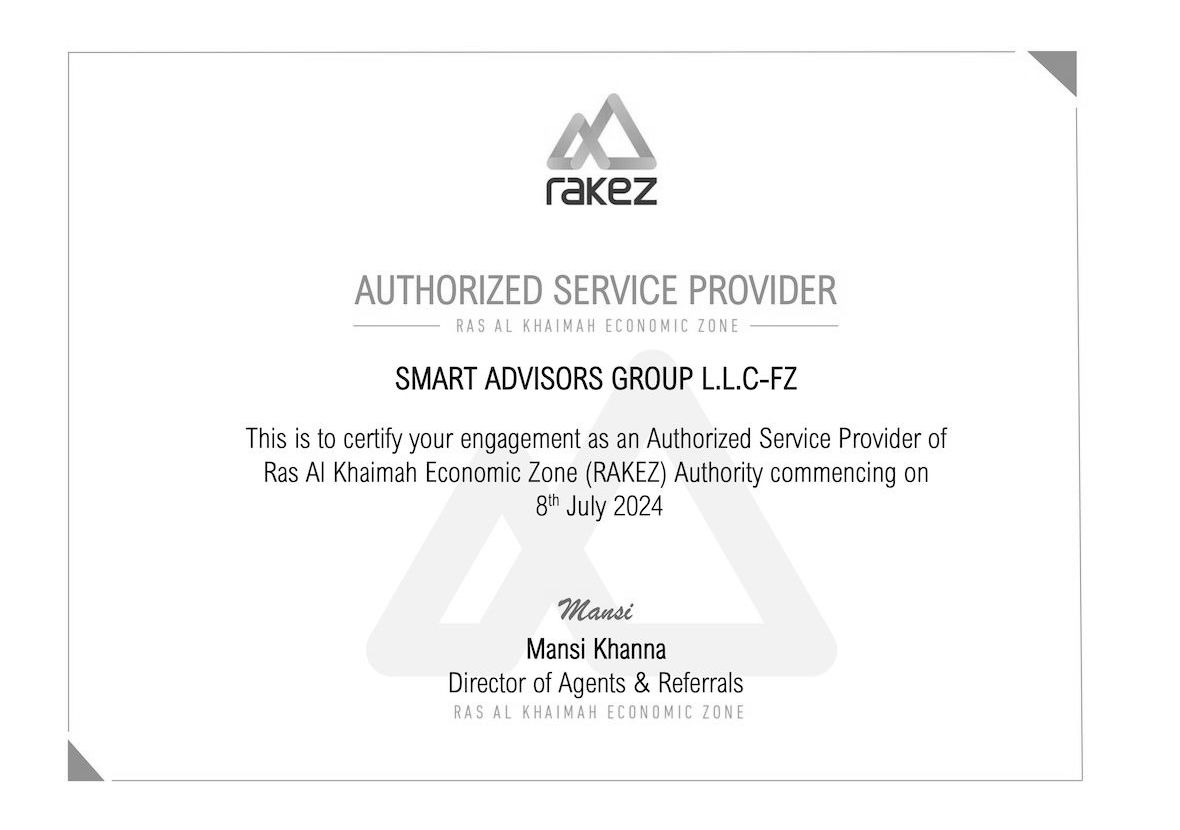

Our Commitment to Excellence Has Been Recognized

At Smart Advisors, we have extensive experience in the UAE setups, tax-related issues and private capital solutions. We bring each client a combination of deep industry knowledge and expert perspectives for any business and personal needs, by offering our clients fresh strategic visions and breakthrough business insights.

UAE local bodies trust us. We have been accredited by Dubai Chambers as well as by major free zones such as IFZA, JAFZA, Meydan, UAQ, DMCC, DWTC, RAK ICC, and others.

Our Services

Knowledge & Experience

As the UAE continues to grow as a hub for international business, legal advisors with strong knowledge and experience in corporate and private law are in high demand. As legal advisors specializing in UAE business setup, we have strong knowledge base and practical experience in both corporate and private matters. Staying up-to-date with changes in laws and regulations, as well as building a strong professional network, contribute to our and our clients’ success in the UAE business environment.

Corporate Law

Commercial Law

Private Law

Private Assets Protection

Cooperation with UAE Bodies

Business Relocation & Visas

Meet Our Team

View AllOur experienced team is dedicated to providing the highest quality services to our clients, and we pride ourselves on our deep knowledge and understanding of the UAE business environment. We take the time to listen to your needs, answer your questions, and explain your options, so you can make informed decisions about your business matter. We have the expertise and dedication to help you achieve your goals via our tailored solutions.

Basil Rida Al Kair

- Public Relations OfficerThe Binary Tower, Business Bay, Dubai+971 52 204 8309E-Mail

Satisfied Clients’ Stories

Paying Taxes / Penalties in UAE in 2026: Rules, Risks, and Best Practices

Paying taxes in the United Arab Emirates (UAE) is technically a straightforward process....

VAT Law Amendments in the UAE

Although separate from the VAT law itself, amendments to the Tax Procedures Law (Federal...

UAE Mandates Electronic Invoicing: a Complete Shift in Billing and Tax Compliance

This initiative represents one of the most far-reaching reforms to the UAE’s fiscal...

UAE Free Zones Tighten Financial Reporting Requirements

Whereas many free zones previously allowed companies to operate without regular reporting, today...

Owning a Company in the UAE: Opportunities Come Along with Responsibilities

However, it’s important to understand that registering a company and opening a bank account is...

Happy New Year!

Smart Advisors Group congratulates you heartily on the coming New Year! These last days of the...